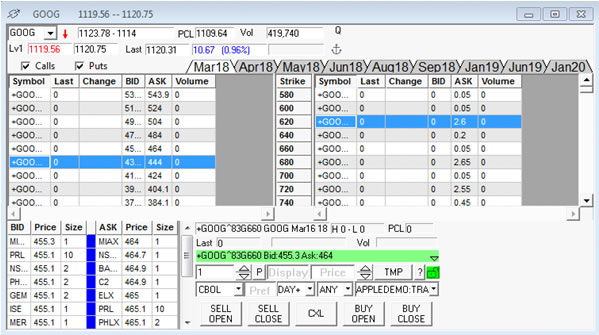

The Option chain is available in the software for accounts approved to trade options by their broker. Go to “QUOTES” on menu bar and select “Option Chain” to bring up the “Options” window. Enter the symbol in the symbol box located in the top left corner of the window and hit enter. To trade a contract, left click on the contract symbol in the SYMB column. In the trading section of the window (similar to that of a Montage Trading window) enter the number of contracts, select ITSM (Market), ITSL (Limit), and ITSS (Stop) route, enter the price, select your trading account and click on the execution side button.

(Note: The routes that end with “M” indicates a market route. The routes that end with “L” indicates a limit route. The routes that end with “S” indicates a stop route.)

First of all, you have to ensure the data package you are subscribed to contains the Options feed. Then go to Quotes menu and select Option Chain to open the options trading window.

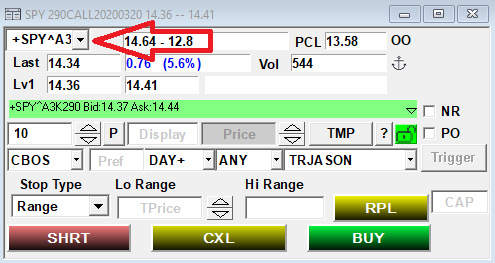

(Please Note: “^” denotes Call contracts, and “” denotes a Put contract. For example, “+GOOG96S1107.5” denotes: Option for GOOG, Put, 2019 June 28, Strike 1107.5. And “+SPY^A3K290” denotes Option for SPY, Call, 2020 March 20, Strike 290)

DAS Option Symbology consists of five parts as explained in details as follows:

Part 1 > The plus sign, ‘+’. This is the option indicator. Any symbol preceded by this sign will be identified as an option contract in DAS platform.

Part 2 > The option root symbol. No white space allowed before, after or in between. Its length is variable.

Part 3 > The Call/Put indicator, ‘^’ denotes Call contracts, ‘*’ denotes Put contract.

Part 4 > Expiration Date. This consists of 3 letters: the first letter denote year, second denotes month, last denotes day.

- For year, we start from year 2010 as 0 and represents with ASCII ‘0’, start from 2020, change to ‘A’, 2021 will be ‘B’, etc.;

- For month, “123456789ABC” used for Jan to Dec;

- For day, “123456789ABCDEFGHIJKLMNOPQRSTUV” which will be day 1- 31.

Part 5 > Strike price. This will be the explicit decimal representation, and the decimal point will be included when necessary.