Limit Order

In the Montage Window, select a Limit Route from the Route drop-down menu to place a limit order. A price limit is specified for this type of order. If your order is executed, the price will not be higher on a buy or lower on a sell than the limit you specified. Limit orders are the safest way to enter an order, since they “limit” the possible price of the execution. (Note: The routes that end with ‘L’ indicate it is a route for limit order. Ex: ‘ARCAL’ will be a limit order sent to ARCA route.)

Market Order

In the Montage Window, select a Market Route from the Route drop-down menu to place a market order. A market order is an order that is entered without a specified price. It is an order to buy or sell at the current market price, whatever that may be. In a rapidly moving market, it is common to get an execution significantly higher on a buy or lower on a sell than the price at the time the order was entered. (Note: The routes that end with ‘M’ indicate it is a route for limit order. Ex: ‘ARCAM’ will be a market order sent to ARCA route.)

Stop Orders

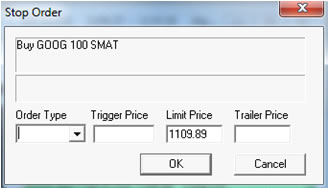

In the Montage Window, select the route STOP from the Route drop-down menu for a stop order. Bring up a security in which a position is held on a Trade Montage window. Select the appropriate route designated for stop orders. If you are “Long” in the position, click the “Sell” button. If you are “Short” in the position, click the “Buy” button; from here, the “Stop Order” dialog window will show up. See below:

There are four types of stop order; Stop Limit, Stop Market, Stop Trailing, and Stop Range. (Note: The routes that end with ‘S’ indicate it is a route for stop orders. Ex: ‘ARCAS’ will be a stop order sent to ARCA route. STOP Price is triggered off the last print in between the BID and ASK price. For example, Bid =<Last <=Ask. It does not use the print in the Time and Sales.)

Stop Limit Order

To place a stop limit order, click the down arrow button in the “Order Type” box and select “Limit.” Here, two prices need to be entered; the Trigger Price and the Limit Price. The Trigger Price will decide when this order will be active/trigger. After it is triggered, it will become a regular Limit Order.

Stop Market Order

To place a stop market order, click the down arrow button in the “Order Type” box and select “Market.” Only the Trigger Price needs to be entered. The trigger price will decide when this order will be active/trigger. After it is triggered, it will become a regular Market Order.

Stop Trailing Order

To place a stop trailing order, click the down arrow button in the “Order Type” box and click on “Trailing”. Here, place in the “Trailing Price” box the decrement that you would like the trailing stop to be activated (e.g. enter 1 for $1 trailing stop), and click the OK button. The “Trailing Price” box can only take decimal numbers such as 1.5, 0.1, 1.01, etc.

A trailing stop order will be activated once the decrement set below the current market price is reached. Trailing stops will move up along with the current market price. (For example, if you place a $1 trailing stop when the current market price is $100, the stop would be activated if the price falls to $99. If the stock price moves up to $103, your trailing stop will move up with it and will now be activated if the price drops to $102.)

Stop Range Order

To place a stop range order, click the down arrow button in the “Order Type” box and select “Range”. Here, two prices need to be entered. Enter a price below where the stock is currently trading at in the “LowPrice” field, and enter a price above the trading price in the “High(Stop)Price” field. When it reaches one of the prices of the range, it will trigger the appropriate buy or sell order.

(Note: A MARKET order will be sent when the Stop price is reached (LowPrice for SELL orders, HighPrice for BUY orders), and a LIMIT order for the target price (HighPrice for sell orders, LowPrice for buy orders). In other words, for a BUY Range Order, it will become a MARKET order if it is triggered by HighPrice, and became a LIMIT order if it is triggered by LowPrice. Similarly, for a SELL Range Order, it will become a MARKET order if it is triggered by LowPrice, and became a LIMIT order if it is triggered by HighPrice.)