Yes, there is. However before I give all the bullet points to all the advantages to using DAS Trader with TD Ameritrade, I want to delve into a couple of other questions; such as whether Schwab – TD Ameritrade post recent merger of Charles Schwab acquiring TD Ameritrade it will emerge as the supreme broker for U.S. Stock trading? And why is Robinhood failing on cyber security and compliance and has it impacted their ability in attracting new customers?

Will Schwab – TD Ameritrade win against the other online US brokers?

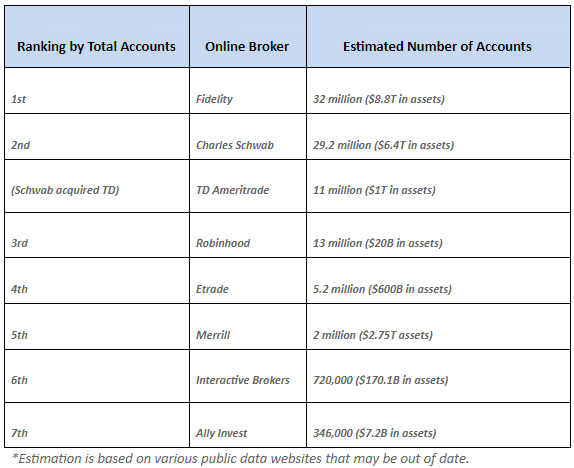

Since the Covid-19 pandemic, many people have taken up online investing in the U.S. Stock Market to either pass the time while being home or looking to add or replace revenue after being furloughed from their job. These new investors flocked to any U.S. broker to get their accounts setup, with the bigger brokerage houses offering zero commissions such as Fidelity, Robinhood, Etrade, TD Ameritrade and Charles Schwab grabbing even more market share on payment for order flow through these new emerging investors. Robinhood post Covid-19 now has a total of 13 million customer accounts, making it the 2nd largest broker per account. Although, the true giant by number of accounts since post Covid-19 amongst the U.S. Brokers is now Schwab Ameritrade, with the finalized merger of Charles Schwab having had pre-merger 28 million customer accounts and TD Ameritrade, 11 million customer accounts. Schwab-TD Ameritrade is estimated to now have almost 39 million accounts, which now makes them the largest U.S. online broker; surpassing Fidelity who had 32 million customer accounts. Other brokers globally also experienced growth in the total customer base due to this demand. A few market trend analysts are comparing this day trading boom to the year 1999, when day trading peaked and everyone was trying their hand at it. What these new investors are realizing is that to effectively day trade and consistently make money, they do need more than just free commissions; they need to have experience in trading knowledge, better trading tools, a safe brokerage and reliable technology. These are areas that Robinhood, despite being the 3rd largest by total number of customer accounts, had been falling short on in 2020.

Why did Robinhood fail their account holders so terribly this year?

Robinhood had been in the news quite often in 2020 for more than just failing on compliance related issues and subsequently being fined regulatory violations by the SEC and FINRA. At the start of the Covid-19 pandemic in March 2020 to May 2020, their system crashed many times and proved not to be capable of keeping up with the increased volume of the U.S. Stock Market. In all fairness, many other online brokers also struggled on certain days as the volume spiked and was 5 times greater than normally active days. There were several circuit breaking days triggered by this increase by NYSE and Nasdaq. As a newcomer to the industry, I give Robinhood props for kick-starting the interest in online investment to a generation so disconnected from all others with ideals and ethics. They certainly disrupted the current model at just about the right time with their commission free model when all other online brokers had maintained a low commission structure. However the problem is that they seemed to have leapt without first checking what other established firms knew from industry experience and then they simply fell short in the most critical areas. I have said this in a prior blog that the free commission model was not invented by Robinhood, but I feel their greatest shortcoming is that they didn’t invest in the right infrastructure and expertise. This unfortunately is not surprising as this is what most unicorns with venture capital financing do; they invest the money into a larger and bloated workforce while skimping on the technology and areas most needed such as Compliance and Risk Management. They wagered on the premise that they just need to offer a very simple trading system for dummies as their traders were not sophisticated enough to understand how the market actually operated. There was no learning curve needed for their traders in understanding how the market works or on advanced trading strategies such as options trading. And it served them well in gaining the market share of traders at about the right time. As it proved they were right based on the sheer number of traders who flocked to them and who didn’t care much about how trading works or that their orders were being sold to high frequency algorithms designed to win on every trade. Being the market disruptor, Robinhood built a model based on catering to the masses without any regards to structure and the rules intended to keep the U.S. market transparent and fair.

Near the end of 2020, it was exposed that over 2000 Robinhood account holders were compromised by hackers who wiped out these accounts’ entire holdings and easily transferred the money out of the accounts to 3rd party online e-wallets. As we noted by the embarrassing vulnerability caused by the SolarWinds incident in December 2020, Cyber Security is becoming more problematic due to a shift to allowing 3rd party access to big data and increased usage of online depository holdings or websites which capture online activities. It clearly brings up the questions of how this could have happened to such a large brokerage house such as Robinhood, when there should be enhanced account security safeguards in place such as 2FA sign-on and verification process to add-on e-wallets. The problem there though lies beyond having the account holder using greater security, but the uncomfortable direction of opening up their data of account holder’s information for 3rd parties to easily access and without having stricter policies on confidentiality and usage.

Robinhood is certainly not the only financial firm who have been targeted by hackers and they certainly won’t be the last. We live in an age where data and content is being freely offered as “open source” for anyone to use. And the expectation is now that all data should be freely and easily attainable even at the cost of security.

Why is DAS Trader the better option?

During the height of the Covid-19 pandemic, the DAS platform never faltered in its security nor did it have failures in its infrastructure. Even during such a volatile time in the stock markets, our users were able to rely on our software to continue to watch the markets and trade uninterrupted. From early on, DAS invested heavily in its infrastructure and to this day, continues to invest as many resources as possible into ensuring our infrastructure remains robust, secure and as efficient as possible.

Alongside our powerful infrastructure, DAS also ensures that user accounts are secure and our firm operates as a “closed source” environment or rather proprietary controlled environment with only offered access to our trusted partners. This means we carefully vet each and every party who integrates with our technology to ensure that they operate a safe and secure environment and they themselves take strict measure to safe-guard client’s information.

I want to highlight that TD Ameritrade and Interactive Brokers (IBKR) are both great brokers for investors who are looking for a broker that is strong on client security and compliance. IBKR does have the advantage of offering a better environment for direct access trading for retail clients over TD and all the other online brokers in the above list. Please note that TD is not a direct access broker and the orders are executed by their logic and not the DAS platform. But the TD and Schwab merger now make them a very serious contender in the online brokerage space when offered with our platform. Here are just a few advantages to using TD Ameritrade via the DAS Trader platform:

- TD Ameritrade is commission free with access to 2 direct routing destinations for limit orders: ARCAL and INETL.

- A real-time clean and reliable market data feed display for stocks, options and fundamentals data.

- Stable and safe trading order entry to the TD Trade matching engine.

- Access to our DAS Trader all-in-one software which bundles tools such as customizable hotkeys/buttons, user accessible Risk control settings, real-time News, Intra-day tick by tick charting and technical analysis, integrated market scanners and markets depth across U.S. stock exchanges.

- High level customer service and software support on-demand during market hours, which is one of the most critical times traders need help.

In conclusion, if you are new to online trading and investing in the U.S. Stock market, you should be looking for more than just free commissions. Having your money at a broker who understands the nuance of the market should be important to you as well as trading in an environment that is safe and reliable.

For more information on our integration with TD Ameritrade, please check out our knowledge base article here.

To subscribe to DAS Trader AMTD please click here.