Financial news is one of the most important factors that can influence the behavior of investors and traders in the US stock markets. Financial news can provide information about the performance, outlook, and risks of different companies, sectors, and economies, as well as the actions and expectations of the Federal Reserve and other policymakers.

Financial news can affect the supply and demand of stocks, which in turn determines their prices. If more people want to buy a stock, its price will increase. If more people want to sell a stock, its price will decrease. The relationship between supply and demand is highly sensitive to the news of the moment: https://www.investopedia.com/ask/answers/155.asp

Financial news can have both positive and negative effects on stock prices, depending on the nature and significance of the news. Positive news can boost investor confidence and optimism, leading to higher demand and higher prices. Negative news can erode investor confidence and optimism, leading to lower demand and lower prices.

Some examples of positive news are:

- A company reports better-than-expected earnings or revenue growth

- A company announces a new product launch, a merger or acquisition, or a dividend increase

- A sector or industry benefits from favorable market trends or regulatory changes

- The economy shows signs of strength, such as low unemployment, high GDP growth, or low inflation

- The Federal Reserve signals that it will keep interest rates low or provide stimulus to support the economy

- Some examples of negative news are:

- A company reports worse-than-expected earnings or revenue growth

- A company faces a lawsuit, a scandal, or a product recall

- A sector or industry suffers from unfavorable market trends or regulatory changes

- The economy shows signs of weakness, such as high unemployment, low GDP growth, or high inflation

- The Federal Reserve signals that it will raise interest rates or tighten monetary policy to curb inflation

Financial news can also have different effects on different types of stocks. For instance, growth stocks, which are expected to have high earnings growth in the future, tend to be more sensitive to news than value stocks, which are undervalued by the market. Similarly, cyclical stocks, which are tied to the business cycle, tend to be more sensitive to news than defensive stocks, which are stable regardless of economic conditions.

Financial news can also have different effects on different time horizons. For short-term traders, who buy and sell stocks within days or hours, financial news can create volatility and opportunities for profit or loss. For long-term investors, who buy and hold stocks for years or decades, financial news can create noise and distractions from their fundamental analysis and valuation.

Therefore, it is important for investors and traders to be aware of the financial news and how it can impact their decisions and strategies in the US stock markets. Financial news can provide valuable insights and information, but it can also create confusion and uncertainty. Investors and traders should always do their own research and analysis before making any investment decisions.

This chart shows the performance of the Dow Jones Industrial Average (DJIA), one of the most widely followed US stock indexes, over the past year. The DJIA tracks 30 large-cap US companies from various sectors. The chart shows how the DJIA has reacted to various financial news events over time.

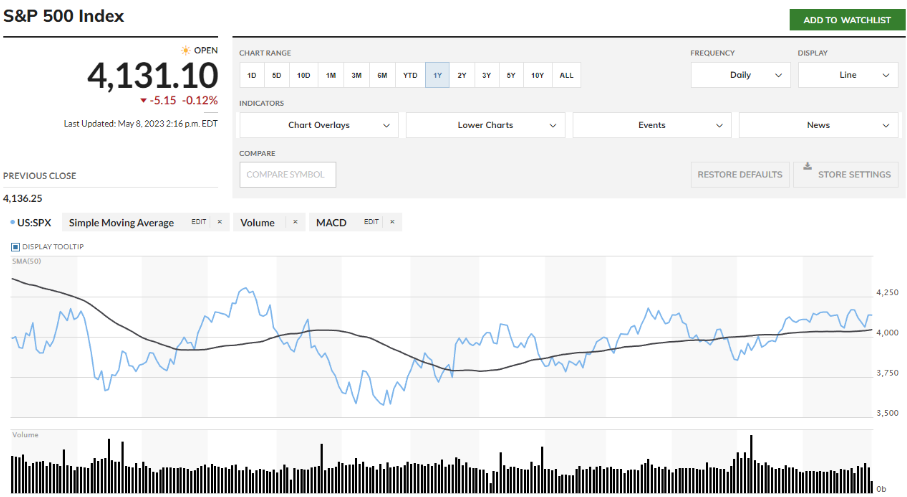

This chart shows the performance of four major US stock market indices: DJIA (blue), S&P 500 (red), Nasdaq Composite (green), and Russell 2000 (purple). The Nasdaq Composite tracks over 3,000 companies that trade on the Nasdaq Stock Exchange, mainly from the technology sector. The Russell 2000 tracks 2,000 small-cap US companies from various sectors. The chart shows how these indices have performed relative to each other over time.

While this blog post does a good job of highlighting the major indicators of financial news within the Stock Market, did you know that DAS Trader has a built-in news channel within the software? With 2 simple clicks, you can read all the news that is currently going on within the financial market., as well as filter out any news you don’t wish to see! There’s that and much more within our software so make sure to check out our website: https://dastrader.com/ for more information.