Before there was Robinhood, which many new investors believed set the stage for Free Commission trading and claimed itself to be the pioneer of zero commission in 2012, there was in fact FreeTrade.com, a division of Ameritrade Holding Corporation (www.amtd.com). FreeTrade preceded RobinHood in the year 2000 and was founded almost 50 years ago in Omaha, Nebraska and later became TD Ameritrade though several acquisitions of all the other discount brokers, and thus was the true pioneer. At that time, I was already involved in high-speed trading as many of us were in the day trading field. We all migrated from the online discount broker model in which we were limited with the technology offered and price execution. I admit I opened an account to test out the offering and I traded there for a few months. Here is what was offered by Freetrade.com:

- Free commission on Market Orders through the Internet – “Freetrade.com is the ultimate discount broker — a virtual company. Instead of offering LOW commissions for qualified accounts, we offer you NO commissions on Internet market orders. We do charge $5 for stop and limit orders and odd lots, but hey, we’ve got to earn something here.”

- Limited Customer Service and Trading Support – “All trades and customer service will be executed by and through the Internet. Customers will not be able to telephone Freetrade.com. You can understand this would help reduce our costs of operation and increase our opportunity to succeed. E-mails for customer service will be responded to quickly, and confirmation of trades will be reported immediately.”

- Web based Trading Application in which they stated “Our site features dynamic postings of your account activity. Your account positions, margin balances and transaction activity will be updated in real-time throughout your portfolio. In the event that the primary trading site is unavailable, we built a truly redundant back-up trading site that will seamlessly handle your orders. The site will automatically appear on the web-trading page, with a notice to you of its implementation.”

Although they clearly stated that it was only free for certain types of orders, they were proper to disclose how they were making money. What I liked about them is that they were very transparent and clearly explained how the model worked to its account holders.

“We must also generate revenues, and we do that in four primary ways.

- The traditional interest income system: loaning customers funds against securities in a margin account.

- Market Makers and Specialists that execute trades may pay us for the order flow. This system of payment got started because execution facilities were not efficient, and the size of the market had gotten larger. This payment used to average $9.00 per order for us at Ameritrade and was instrumental in helping us reduce our costs to customers. In fact, without it, commissions would not have come as low as they are. However, as the markets have become more efficient and competitive, this revenue source has been reduced dramatically. In fact, for the last several quarters it has been as low as $1.50 per trade.In the year 2000, the industry may gravitate to decimal pricing. If and when that happens, spreads on quotes may narrow, and this revenue source may continue to go down and disappear. Hopefully, by that time our other revenue sources will be large enough for Freetrade.com to survive.

- We will sell advertising on our website. This is a good way to let the advertisers pay for your commissions. However, we will not sell your name and address or any information about your personal account to anyone. We will absolutely maintain your privacy. We will describe demographic and cyclographic information on our customer base to advertisers but will maintain the privacy of your account.

- Payment for market information flow. It is your activity, our customers’ activity, that provides the execution destination with the information to establish the Bid and Ask quotes. Quote vendors then charge for this information. We think that this is more than an economic indiscretion. When their payments were started years ago, the idea was to cover costs. However, currently these execution destinations reap revenues of hundreds of millions of dollars due to the increased size of the market. Also, the quote charges are biased against the electronic customer since you — the investor — provide the information for these quotes. You should not have to pay a high price or be subject to discrimination.”

Unfortunately, the model only lasted until the 2008 recession and was shut down in early 2009. I won’t get into the full history lesson as to what exactly happened to the US market thereafter, but I feel it is important to compare the past lesson to present events in order to better determine the future of online trading.

Earlier this month, five of the largest and most well-established US online brokerage houses, including TD Ameritrade: Etrade, Schwab, Fidelity and preceded by Interactive Brokers (IBKR), announced that they will be offering a commission-free model. It jolted my memory that TD Ameritrade is not new to this model and perhaps they felt it was now the right time to jump back in. Or perhaps they are simply joining the others in the game of market share. What does this new competition mean for Robinhood, who seems to have dominated the commission-free market share since its launch in 2012? Interestingly, Robinhood earlier this year seemed to be poaching the other brokerage house commission-based model with the launch of Robinhood Gold and the offering of Level 2 market data. The quest for market share is based primarily on the brokerage house routing and the reselling of orders in their accounts to the exchanges, high frequency liquidity providers, market markers and big banks in exchange for Payment for Order Flow (PFOF). All brokerage house participate in PFOF, and although in Robinhood’s case it was the primary source of revenue in addition to taking the big spread between the National Best Bid and Offer (NBBO) and the fill price executed for their customers, they barely scratched the surface in monopolizing the online brokerage industry.

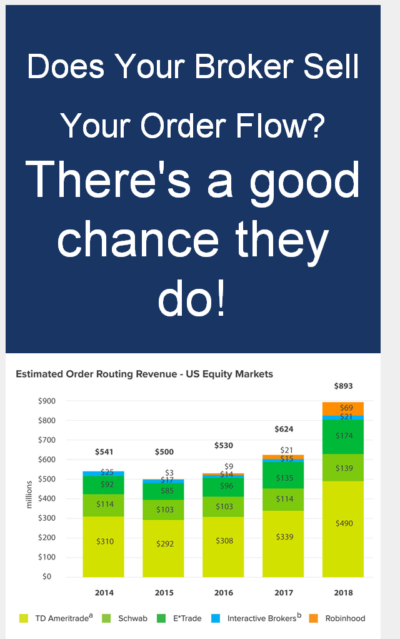

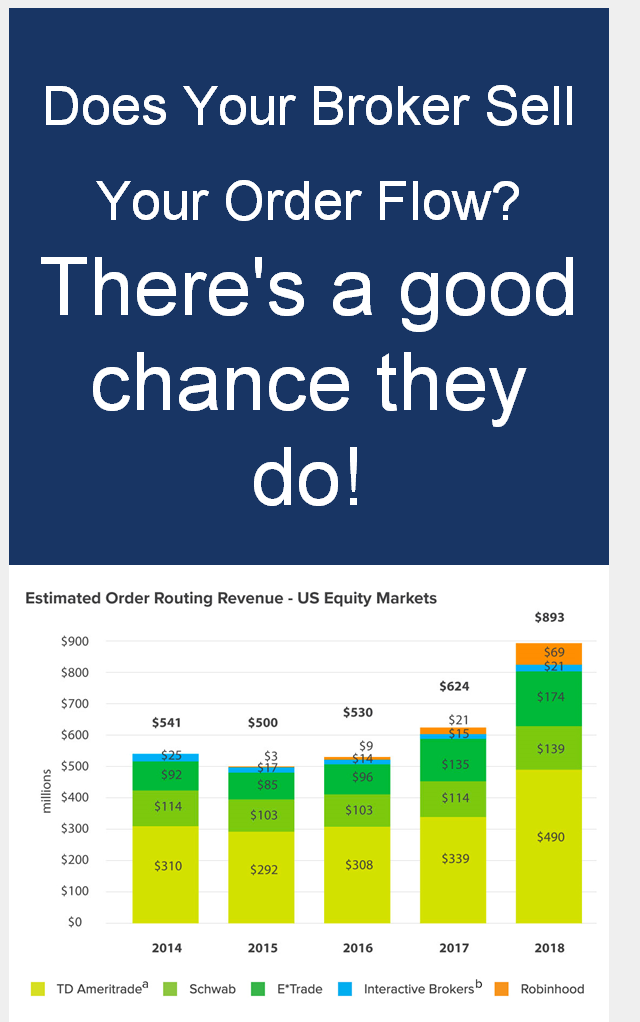

I want to point out in the history lesson that this model is not revolutionary. It is also not designed to help out the smaller investors in the stock markets to gain wealth by saving on commission fees, nor is it really truly free and altruistic. It is in fact quite the reverse. There is big money to be made in the PFOF model. As to why the others who may not have been as vocal about it as Robinhood, they finally made the decision to add-on and adopt Robinhood’s version of putting a pretty spin on it by calling it free trades. Take a look at this chart study below created by IBKR and sent to their prospectors in June 2019. Not surprisingly IBKR, who had the smallest volume for PFOF, made the decision before the other four to introduce this model after conducting this study below and decided to adopt the Robinhood model in hopes of capturing more market share from the bigger houses. As you can see it’s apparent who has more of an edge than others and its as if they are predators closing in on prey.

You might be thinking who care, “if I am not getting the best fill, I’m at least still saving by not paying for commissions. And I don’t care if it is the watered down access to the US stock market.” This is not the case however, and you should care if you want better executions and higher profitability. Although I think this may be the ideal environment for individuals who are new to investing and trading on their own or who are only looking to do long-term trading. It is not right for more active traders. If you are an active trader or looking to become a better trader this is the absolute worst structure to be in to day trade for a living. Everything in this environment is a disadvantage to the smarter trader. And here are the reasons why:

- Free is not really free – As I pointed out earlier with the history lesson of Freetrade.com and its predecessors, commission-free comes with conditions which many investors are not reading carefully or aware of as it may be in very small print.

- The tools provided to trade in this environment is subpar and very limited in order to keep the operation cost at a minimum. And this is not beneficial to the traders. The trading environment offered is always a web-based lite application coupled with delayed market data by 15 minutes. If you are trading a very volatile security, this is extremely risky. You are essentially trading blindfolded without a walking stick as you are not seeing the full depth of the market in real-time and not having the ability to execute trades faster using hot-keys or being able to enter advanced order types such as a range or stop loss which are very critical in being profitable and mitigating loss. These standard features are not offered on a free web-platform.

- There is no opportunity of price improvement. All commission based brokers must offer their account holders the opportunity of price improvement by getting the highest bid price on a stock. This is often not offered in commission-free environment. Getting the best price means you end up winning on a trade. And yes trading is a competition in which you are trading against algorithms (ALGOs) you are both competing for the best bid or ask in the auction.

- There is no opportunity of rebate sharing. Your trades are being sold to the sophisticated traders consisting of the algorithms run by market markers, dark-pools, and alternative trading systems (ATS) who are very eager to buy your order flow as it is blind, a term commonly coined “dumb.” Additionally, the PFOF is not even being shared with you in this commission-free arrangement. It is unfair to trader, but on the same token the trader has agreed to that arrangement by forfeiting paying commissions and all execution cost.

Will this model become mainstream for the US online trading? This is hard to predict as there are a few factors which might impact this model. One is whether we are again heading towards another recession which causes a lot of people to either exit the financial market or turn to day trading as an alternative revenue source. I am foreseeing more emphasis on rebate trading or the maker taker model becoming more widely understood by those who graduate from merely investing to becoming smarter traders. I do not believe commission-free accounts will ever truly be free as it is not organically sustainable, as proven by Robinhood who is backed by venture capital money and still requires continuous infusion of capital from some other revenue source than PFOF. I do wonder whether we as a society will continue to be desensitized and accepting that we are being sold as part of larger data and how will this truly revolutionize e-commerce and the internet. I have to be hopeful in thinking that at some point traders who may have started out using the “free” with conditions will eventually come to realize this and want and expect more.

And this is where direct access and high-speed trading comes into play as it did in the early 2000s. Traders, like technology, are constantly improving and eventually they will come to the realization that commission-free trade does not offer them any edge or advantage at winning in the market. At some point they will wisen up to realize that a penny-wise and pound foolish mindset won’t help them achieve financial growth and independence.

I conclude this by offering the following advice: those who feel they need to start out in a commission-free environment should go with the house with the least market share participation model in the group, for they might be more inclined to value your order flow the most and be willing to offer you rebates and access to better technology