Blog

What are some common mistakes to avoid when trading options?

Options trading can be a rewarding but also risky way...

Read MoreHow to Profit with Trading the Options of a Stock

Options are contracts that give the buyer the right, but...

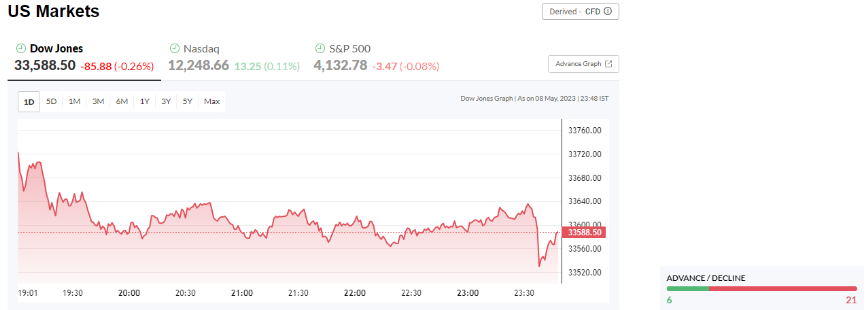

Read MoreHow Market Depth Such as Real-Time Level 2 Market Data Can Help an Investor Make Better Trading Decisions in the US Stock Markets

Market depth is a term that refers to the amount...

Read MoreHow Financial News Can Impact How Investors Trade the US Stock Markets

Financial news is one of the most important factors that...

Read MoreIs there an advantage to using DAS Trader AMTD?

Yes, there is. However before I give all the bullet...

Read MoreA Look at Different Types of Trading Styles, Including Swing and Day Traders and Stock Options

After a recent live stream interview with two of the...

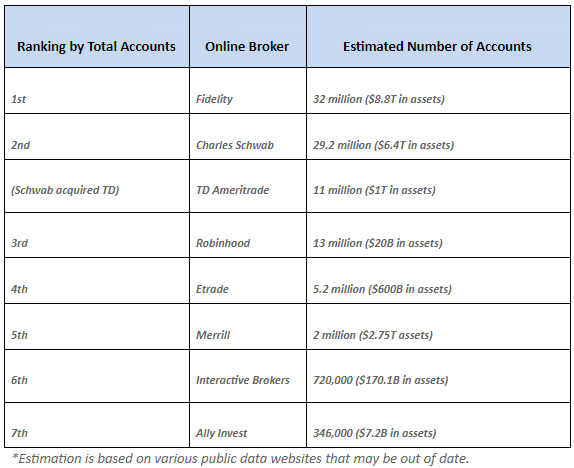

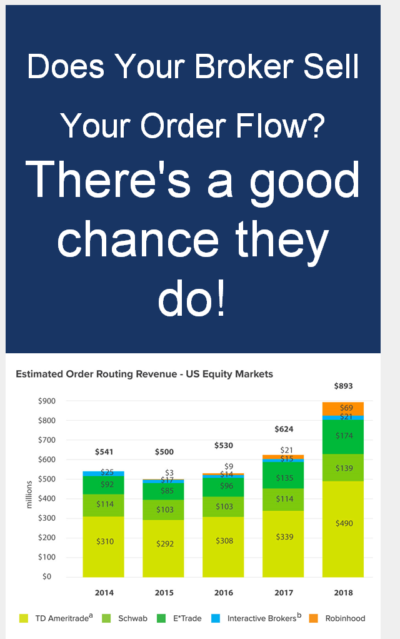

Read MoreIs There An Edge to Free Commission Trading?

Before there was Robinhood, which many new investors believed set...

Read MoreIntroducing the Short Locate Feature to the DAS Software

DAS is pleased to announce the Short Locate application on...

Read MoreWhy Clearing Houses and Clearing Firms are so Important to the Stock Market

Why Clearing Houses and Clearing Firms are so Important to...

Read MoreHow to Cope with Trade Loss

No matter how much you practice or how in tune...

Read More